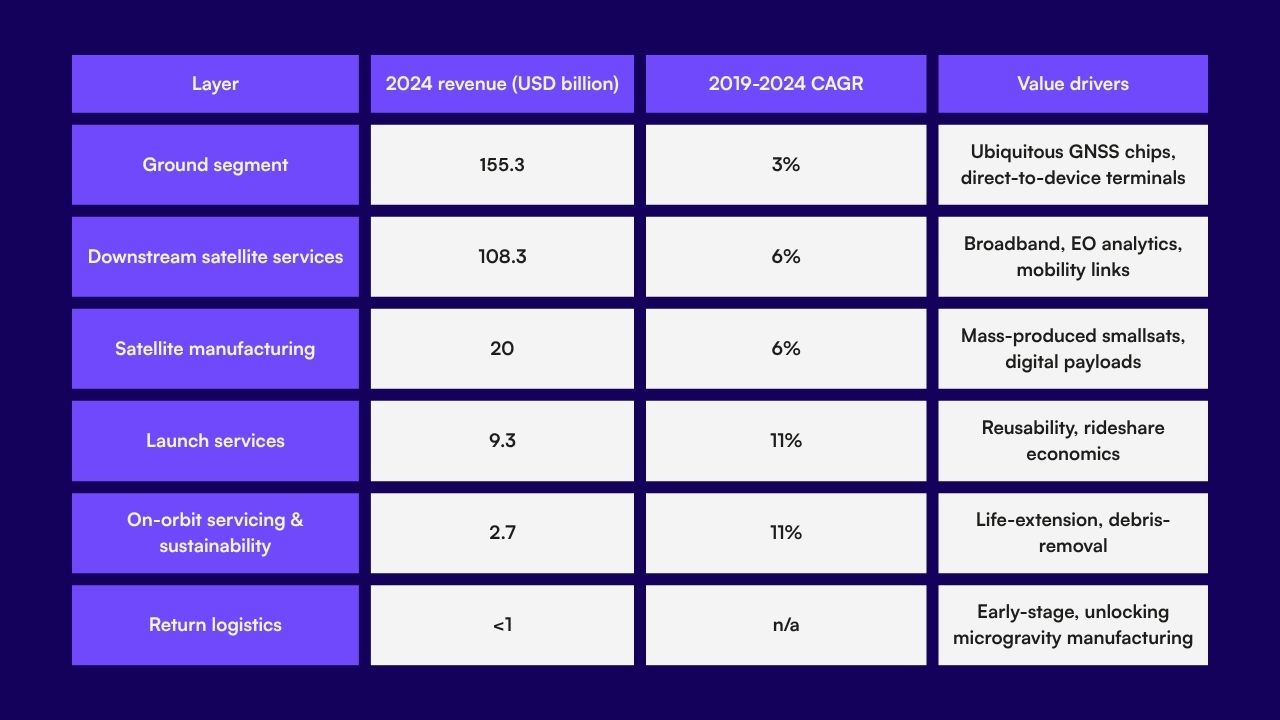

Space is no longer the preserve of agencies and astronauts. It’s a $415bn commercial playground where phone-sized satellites launch weekly, rockets land on their tails. and private firms earn nearly 71% of all sector revenue. Most of the money still rolls in on the ground—think Global Navigation Satellite System (GNSS) chips and satellite data pipes—but new tech is shaking up the data layer. High-speed Ka-band antennas, satellite networked open ground stations (SatNOGS), and optical lasers are enabling cheaper and faster data transmission. On-orbit servicing (refuelling, debris-clearing, life-extension) is already a multi-billion-dollar area and growing double-digits every year, while return-to-Earth capsules are set to unlock micro-gravity manufacturing.

That’s why our Amadeus APEX Technology Fund backs companies like OKAPI:Orbits, which keeps thousands of satellites from bumping into each other, and ATMOS Space Cargo, whose PHOENIX capsules promise a European down-mass highway for high-value materials. As launch costs keep sliding and orbital traffic keeps climbing, these smart-infrastructure layers—safety, servicing, logistics, data transmission—look set to grab the next wave of margin in the space economy. Understanding where value accrues today—and where it will migrate next—is mission-critical.

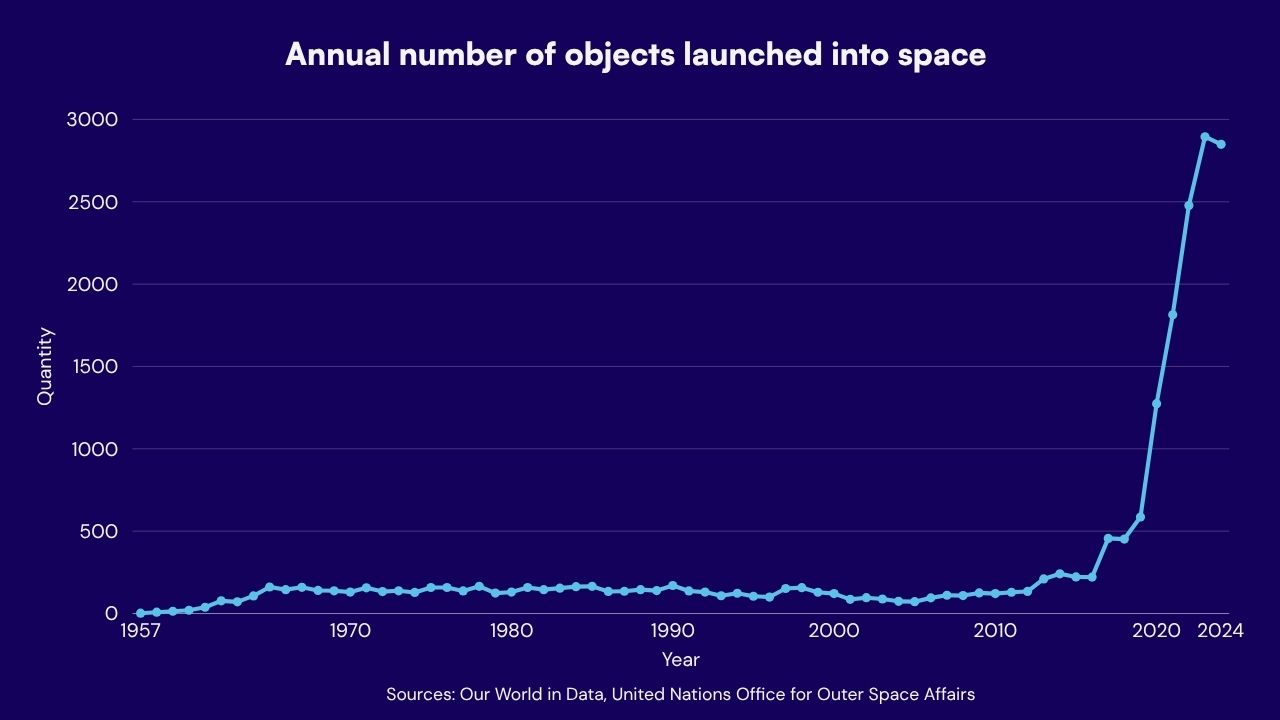

Space Launch Activity Is Skyrocketing

The annual object-launch count—defined as satellites, probes, landers, crewed spacecrafts, and space station flight elements launched into Earth orbit or beyond— jumped from 241 in 2014 to 2,849 by 2024. The trend looks set to continue but at a slower pace, with estimates placing the number of satellites in orbit at 60-100,000 by 2030.