Regenerative medicine – A phenomenal year for new therapies and distributed manufacturing

Today marks a new milestone for cell and gene therapy pioneer Ori Biotech, as the company unveils an oversubscribed $100 million Series B funding round led by Novalis LifeSciences, increasing the total capital raised since inception two years ago to $140m.

The raise will fuel market launch of the Ori system, a full stack, digital manufacturing platform that closes, automates and standardises cell and gene therapy (CGT) manufacturing, with the promise to increase throughput, flexibility, quality and decrease costs by combining proprietary hardware, software, data and analytics. The company is introducing its Lightspeed Early Access Program (LEAP) allowing select partners to gain early access to a platform fundamentally designed to play a critical role in improving patient access to novel therapies, as it opens doors to distributed manufacturing, key to scalable commercial success for therapy developers.

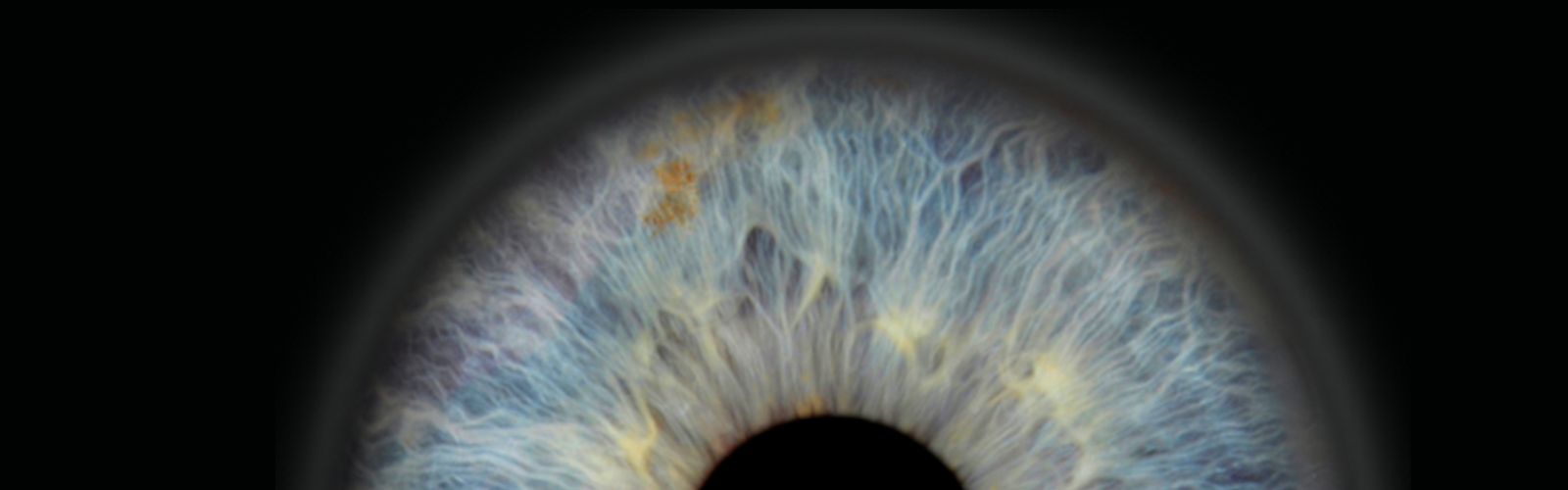

CGTs have the potential to lay the foundation for the next inflection point in drug discovery as they offer the promise of treating, and, in some cases, curing diseases that until recently were considered intractable. The breadth of medical applications spans from rare and devastating diseases like ALS that have few, or no, treatment options, to more prevalent conditions like heart failure, type-1 diabetes, Parkinson’s, Alzheimer’s, and many cancers.

As laid out in a previous blog on the topic, the sector has a fundamental bottleneck: it isn’t compatible with existing manufacturing and logistics set-ups. Let me explain. Cellular and gene therapies both use the body’s own cells and genetic information to fight diseases but do so in different ways. Cellular therapy uses actual cells as the therapy, whereas gene therapy alters the genetic material of a patient, but each of us will have different genetic backgrounds, stages of disease, and medical histories, all of which introduce complexity into the production process. Each patient requires not only a personalised treatment but a unique production process, and the ambition of Ori is to become the reference manufacturing platform in the space.

The company’s rapid ascent and it reaching major technical and clinical milestones didn’t happen in a vacuum. The synthetic biology industry as a whole is thriving and 2021 was a year of records and breakthroughs. CRISPR gene-editing technology was deployed in vivo in human patients for the first time with extremely encouraging interim Phase 1 results. We have seen Yescarta (Gilead) and Breyanzi (Bristol-Myers Squibb) CAR-T treatments significantly outperform second line standard of care for large B-cell lymphoma, the most common type of non-Hodgkin’s lymphoma, which leads us to believe that CAR-Ts and CGTs to follow could rapidly become first-line therapies in immune-oncology. Studies are also suggesting that responses from allo-edited CAR-T cells are in line with that of autologous CAR-Ts, which was long suspected but remained to be demonstrated.

Another paradigm challenged last year was that one cannot reverse the damage that has already occurred. The conventional wisdom is that with degenerative conditions the journey is a one-way street and therapies can only prevent further damage. We now have notable examples where that is not true. Possibly the most exciting results we saw were with a type-1 diabetes patient who lived with the condition for 40 years and saw “cure-like results” after 90 days of receiving a one-off treatment of stem cells derived B-cells. If that wasn’t enough, this example also shows the potential of cell and gene therapies for complex, polygenic diseases – again, a space that was thought to be out of reach. We can now replace the lost cells, restore function and reverse at least the symptoms of degenerative conditions.

Not surprisingly, the regenerative medicine sector had a record-breaking year with $23.1B raised, of which gene therapy and cell immuno-oncology took the lions share, each attracting north of $10B in new funding, largely driven by venture capital. A record 26 companies IPO-ed last year, nearly double the previous record of 14.

With six new products approved by regulators it was the second-best year on record and the best year for cell-based immune-oncology with three new CAR-T therapies approved across US, Europe and China. 2021 was an important year for breakthrough therapy and RMAT designation aimed at expediting patient access to regenerative medicine. Seven programs were awarded the designation, pushing the total to 68 since 2017. And we’re on the cusp of an even larger rollout. There are more than 2,600 trials ongoing worldwide, equally split between industry sponsored research and academic sponsored trials, and over 9,900 cell therapy trials are currently recruiting.

It is no longer a question of if distributed manufacturing of CGT will emerge, but when and how prevalent it will become as the industry rethinks treatment delivery. This revolution in accessibility of new treatment modalities is also triggering new business models and we believe that the value chain will look nothing like today. For instance, leading academic centres, such as MD Anderson or University College London, are rapidly repositioning downstream. We tend to forget that most approved cell and gene therapies originated from these research centres before being licensed to big pharma. By using solutions such as Ori they retain control of manufacturing and delivery, and morph into therapy developers cum providers, potentially leaving big pharmas and centralised contract manufacturers out of the equation – unless they, in turn, adapt.

We expect the industry to look profoundly different in years to come, with Ori potentially playing a central role in making life changing treatments available to millions of patients worldwide.