Tobii Raises SEK 400m ($46m) in NASDAQ Stockholm IPO

24th April 2015

Amadeus portfolio company, Tobii, has raised SEK 400m ($46m), before exercise of the over-allotment option, in a heavily over-subscribed initial public offering of mostly new shares on the NASDAQ Stockholm Exchange, capitalising the company at SEK 2.1bn ($242m). Amadeus has not sold shares in the Offering, which was priced at SEK 25, the top of the SEK 22-25 price range.

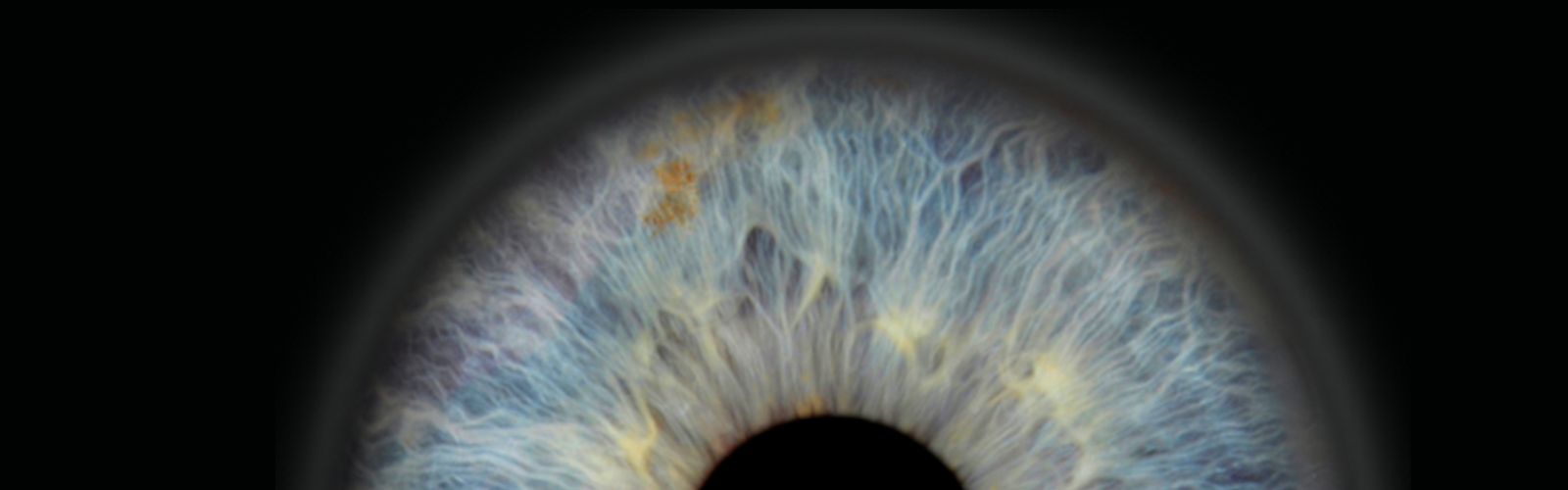

Tobii is a leading supplier of eye-tracking components and platforms. Headquartered in Stockholm, with operations across the US and in China, Japan, Germany and Norway, the company achieved revenues of SEK620 in 2014. In 2014, Tobii acquired US company, DynaVox Systems, its main competitor in the alternative augmentative communications market.

Amadeus first invested in Tobii in 2009 and has supported the company through subsequent rounds of finance,

Hermann Hauser, who sits on the Tobii board of directors, said: “The success of Tobii’s IPO is testament to the strength of the company’s management and its products. We congratulate the team wholeheartedly and look forward to the next stage of the company’s growth with this new capital.”

Tobii is the second Amadeus company to have a successful IPO on the NASDAQ Stockholm, following Transmode’s over-subscribed Offering in 2011. Transmode’s shares launched at SEK 53; today they trade at SEK 112.

END