If you’re new to the category, start with our guide: Deep tech: what it is, what it isn’t, and what proof looks like. It defines deep tech plainly and lays out the proof stack founders and investors use to judge progress.

Pre-seed funding for deep tech is where many teams waste time. Not because the technology is weak, but because the raise is run like a SaaS pre-seed: lots of meetings, broad claims, and milestones that sound sensible but cannot be checked.

Deep tech rewards the opposite. A strong pre-seed round is a tightly scoped plan to reduce one or two decisive uncertainties, backed by evidence that holds up beyond best-case conditions. Investors do not need certainty. They need clarity on what you will prove next, what will count as a pass or fail, and how that proof makes the next round and early deployments easier.

This guide sets out how to do that. We cover how to choose the proof milestone that matters, how investors structure diligence, what to put in an evidence pack and data room, and how to run a process that creates momentum without theatre. We also use technology readiness levels (TRLs) as a practical shorthand for maturity, with the discipline that every readiness claim needs evidence attached. [1]

Disclaimer: This article is for information purposes only and does not constitute financial, legal, or tax advice. It is not an offer or solicitation to buy or sell any investment. Investing in early-stage companies is high risk and illiquid, and investors may lose all of their capital.

Quick takeaways

- Pre-seed funding for deep tech is about funding a specific proof step, not collecting meetings.

- Precision wins. Use acceptance criteria and test conditions, not adjectives.

- Show how your technology behaves as constraints tighten. That’s what buyers and investors care about.

- An evidence pack reduces back-and-forth and often shortens diligence.

- Use TRLs as shared shorthand, but attach evidence to any maturity claim. [1]

- Thoughtful sequencing of IP milestones can signal judgement without over-claiming. [2]

- A focused process and tight targeting can materially shorten a raise timeline. [4]

What pre-seed funding for deep tech means in practice

Stage labels vary by market and by investor. The definition that helps is the one that changes what you build next.

A working definition:

Pre-seed funding for deep tech pays for your first credibility step-change. It funds the proof milestone that makes seed fundraising, and early customer conversations, meaningfully easier.

That definition is deliberately practical. It forces you to name the milestone that unlocks the next decision, rather than treating “pre-seed” as a vague period of activity.

If you want a deeper view of what “proof” looks like across deep tech stages, the proof stack is explained in our deep tech guide.

The pre-seed job: pick the proof that unlocks the next decision

Most pre-seed plans fail for a simple reason. They try to do a bit of everything:

- improve performance

- build a prototype

- “start partnerships”

- “begin commercial conversations”

It reads as busy, not decisive.

A pre-seed plan that raises is usually built around one primary gating uncertainty, plus a small number of supporting milestones. The useful question is:

What is the single thing that, if proven, collapses the most doubt for both investors and early adopters?

This is where founders often get stuck, especially in research-heavy teams. The temptation is to pick the most impressive milestone. The better choice is usually the one that removes the main reason a buyer or investor would say “not yet”.

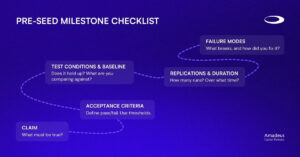

A milestone spec investors can actually validate

For each milestone, use a structure that forces precision and speeds up diligence.

Claim

What, in plain English, must be true?

Acceptance criteria

Define pass/fail. Avoid adjectives. Use thresholds.

Test conditions and baseline

Under what conditions does it hold, and what are you comparing against?

Replications and duration

How many runs? Over what time? What counts as stability?

Failure modes

What breaks, and what did you change to address it?

This format does two things at once. It signals seriousness, and it gives investors a way to validate claims without guesswork.

A useful constraint: if you cannot write acceptance criteria, you do not yet have a milestone. You have an intention.

Pre-seed vs seed in deep tech: the difference is evidence maturity

Revenue is rarely the clean divider in deep tech. A more useful divider is how mature your evidence is, and how close it is to operating conditions.

- Pre-seed: you are proving the core claim and demonstrating a credible path towards a first real-world-like test.

- Seed: you are demonstrating repeatability under tighter constraints and showing early adoption signals that go beyond interest (pilot protocol, integration learning, internal owner on the customer side).

TRLs are often a helpful shorthand here, because they create shared language around maturity, especially when you are moving from controlled validation towards demonstration in a relevant environment.

What investors are underwriting at pre-seed

Investors are not asking you to predict the future. They are assessing whether your team can reduce the right risks quickly with the capital you’re raising.

In practice, they read four risk threads in parallel.

Technical risk

Not “did it work once?”, but “does it hold reliably under stated conditions?”

What helps most at pre-seed:

- conditions and baselines (what you’re comparing against)

- repeatability (not your best-ever run)

- early reliability signals (drift, degradation, edge cases)

- what the next test will change (constraints introduced)

A useful internal discipline is to separate your “best run” from your “typical run”. Most technical diligence is really a variance conversation.

Product risk

Not polish, but whether it fits a workflow and can be integrated without heroics.

At pre-seed, this often means:

- who the user is

- where your product sits in their workflow

- integration constraints (data access, hardware footprint, safety, IT approvals)

- what “success” looks like to the user, not just to the lab

One clean slide here can save weeks of ambiguity later.

Regulatory and standards risk

Even outside regulated healthcare, standards and procurement requirements show up early: safety, security, certifications, compliance evidence.

At pre-seed, “good” is not having everything solved. It is having a credible plan:

- what applies

- what evidence will be required

- what you will start building now

Treat this as an evidence trail, not a future checklist.

Commercial risk

Commercial proof at pre-seed is not a sales funnel. It is evidence that a buyer will engage in a structured way.

The strongest signals are concrete:

- named design partners

- a pilot protocol with success criteria

- a clear operational owner on the customer side

- evidence the problem is urgent, and budget exists

Interest is easy to get. Commitment to a structured pilot is harder, and worth more.

The “relevant environment” gap (and how to communicate it clearly)

Many deep tech raises stall around one gap: moving from a controlled setup to conditions that resemble reality.

TRLs can help communicate this maturity shift, as long as you treat them as shorthand rather than a substitute for evidence. [1]

You can describe the shift without jargon:

- Controlled setup: you prove the mechanism.

- Buyer-like conditions: you introduce the constraints the customer cares about (e.g. temperature, vibration, power, throughput, packaging, reliability, integration).

- Operational use: the customer owns it; maintenance, compliance, and reliability become unavoidable.

What to show instead of a readiness label

Include a one-page environment shift plan:

- where you are testing today

- the next environment that matters

- what constraints will be introduced

- what must change in the system to survive the shift

- what you will measure to call it a pass

Investors can debate a label. They rarely debate a clearly defined test.

Your pre-seed evidence pack and data room

A pre-seed deck gets you meetings. An evidence pack gets you decisions.

The aim is straightforward: make it easy for an investor to validate your claims quickly, without a long loop of clarifications.

Core evidence pack assets (what strong teams share early)

- Test summary with conditions and baseline (include non-best runs)

- Repeatability notes (runs, variance, operator sensitivity)

- Reliability and drift observations (even if early, show you track it)

- Version history (what changed between results)

- Milestone spec for the next 6–12 months (claim + acceptance criteria)

- Pilot or design partner plan with success metrics and ownership

- Constraints register (e.g. materials, power, compute, regulation, integration, supply chain)

- Cost path (range-based is fine, but show the levers and dependencies)

- Defensibility sequencing (what you protect now, what later, what remains know-how)

A practical way to sanity-check your pack: could someone new to the company explain what you will prove next, and how, after reading it for five minutes?

What not to overdo at pre-seed

- huge market slide libraries without tying them to a first buyer workflow

- patent theatre (a list of filings with no strategy)

- overconfident readiness claims without evidence

- “partnerships” that are not attached to a defined test or pilot outcome

The goal is not to look complete. It is to look serious.

Defensibility at pre-seed

Deep tech defensibility is rarely one thing. It is usually a bundle:

- IP where it matters

- process and know-how

- data generated through deployment

- integration advantage and operational learning

At pre-seed, investors are looking for judgement. A simple way to show that is sequencing:

- Now: core mechanism, key claims, freedom-to-operate posture

- Next: process improvements, manufacturability learning, design-to-cost changes

- Ongoing: integration playbooks, yield learning, data moats where applicable

Frame IP as one part of an early defensibility plan and emphasise sequencing to reinforce it. [2]

Investor fit: who is actually a match for deep tech pre-seed

Pre-seed is not won by volume of outreach. It’s won by fit.

A “fit” investor is not just enthusiastic. They can:

- understand your technical claim well enough to ask useful questions

- assess the proof plan and constraints honestly

- help with the next stage, either directly or through the right syndicate

Where fit often shows up:

- specialist deep tech funds (pre-seed or seed)

- sector funds with genuine diligence capability (health, climate, compute, security)

- angels with domain expertise who can validate assumptions and open doors

- strategic partners when they unlock test environments, data, or procurement pathways

Lists and scorecards can help as a starting point, but they work best when you treat them as a filter, not a directory. [3]

Round structure and runway: what pre-seed actually buys you

Founders often talk about round size as a badge. Investors hear round size as a plan.

Runway

Many pre-seed rounds are planned around 12–18 months because experimentation and validation cycles are longer. If you ask for less runway, you need to be confident you can reach a decisive milestone without running out of time mid-proof.

Use of funds

A credible pre-seed budget maps spend directly to proof:

- the people required to run experiments and build the system

- equipment and validation costs

- integration work for buyer-like testing

- early compliance groundwork if it will later gate pilots

- buffer for iteration (because reality has other ideas)

The tighter the mapping from money to milestones, the less narrative you need.

Instrument choice

Convertible or SAFE structures are common. The practical point is how structure interacts with diligence:

- if the structure is simple, the proof narrative must carry more weight

- if you price early, you need sharper comparables and stronger conviction

Keep the structure boring. Make the proof clear.

Process discipline: how to create momentum without theatre

A simple pre-seed process often works best.

Week 1–2: targeted outreach and first calls

Your aim is sorting:

- who understands the space

- who can assess the proof

- who is clearly not a fit

Week 3–4: technical sessions and evidence pack sharing

This is where your materials should do most of the work. If you are sending long follow-ups clarifying basics, the pack needs tightening.

Week 5–6: partner meetings and term discussions

If you have fit and proof clarity, these meetings become decision-making, not education.

The most underrated lever: investor updates

Send short, high-signal updates during the process:

- what you tested

- what changed

- what now holds

- what’s next

A UK deep tech fundraising case study highlights how focus and targeting can shorten time to close, especially when the narrative is clear and investor fit is high. [4]

Common pre-seed failure modes (and how to avoid them)

1) Milestones that cannot be checked

Fix: claim, acceptance criteria, conditions, replications, failure modes.

2) A “pilot” with no operational owner

Fix: define ownership, success metrics, and a decision process upfront.

3) Overstated readiness

Fix: show the environment shift plan and the constraints you will introduce next.

4) No credible cost path

Fix: even a range-based cost story is better than silence. Show levers and dependencies.

5) Too many conversations, too little sorting

Fix: narrow the list, disqualify quickly, protect build time.

FAQs

What do investors want to see for pre-seed funding for deep tech?

Repeatable evidence under defined conditions, a clear next milestone with pass/fail criteria, and early signals you can reach buyer-like testing without relying on vague claims. [1]

How is pre-seed funding different for deep tech versus software?

Deep tech often has to prove feasibility, repeatability, reliability, and deployability before revenue is a meaningful signal. Software can often show demand earlier through usage metrics.

Should I use TRLs in my pre-seed materials?

Use them as shorthand if they help, but attach evidence to any maturity claim. TRLs are most useful when they are grounded in specific tests and defined environments. [1]

What goes in a deep tech pre-seed evidence pack?

Test summaries with conditions and baselines, repeatability data, version history, a milestone spec with acceptance criteria, a pilot plan with success metrics, a constraints register, and a credible cost path.

Do I need patents to raise pre-seed in deep tech?

Not always, but you do need a defensibility plan. Thoughtful sequencing of IP milestones can signal technical seriousness and competitive judgement, especially when paired with know-how and execution advantage. [2]

Conclusion

Pre-seed funding for deep tech is best treated as a credibility purchase. You’re buying the evidence that turns your technical claim into something investible and changes early customer conversations from curiosity into structured evaluation.

The teams that raise well do not necessarily have the flashiest decks. They have the cleanest proof plan. They can say what must be true next, how they will test it, what will count as success, and what changes if it holds. They can also name what might fail, and why that experiment is still worth running.

TRLs can help when you use them as shorthand for a clear environment shift and a defined test, rather than as a label that stands on its own. [1] Defensibility is stronger when you show sequencing and judgement, not big claims about patents. [2]

If you’re raising now, write the milestone spec first. Then build the evidence pack around it. Make it easy for a well-matched investor to validate your claims quickly. Create momentum without noise and you’ll find the right investors.

References

- Equidam — Deep Tech Valuation: Using Technology Readiness Levels

- Tran VC — IP Milestones That Attract Pre-Seed Funding

- Deeptech Seed Fund — Deeptech Seed Fund ScoreCard

- UK Business Angels Association — Hartley Ultrafast pre-seed case study